Start Here: Basics of Indian Income Tax for Individuals

Chosen theme: Basics of Indian Income Tax for Individuals. A clear, confidence-boosting launchpad with relatable stories, plain-English explanations, and practical prompts so first-time and seasoned taxpayers feel calm, informed, and ready. Subscribe for weekly basics tips and drop your beginner questions in the comments.

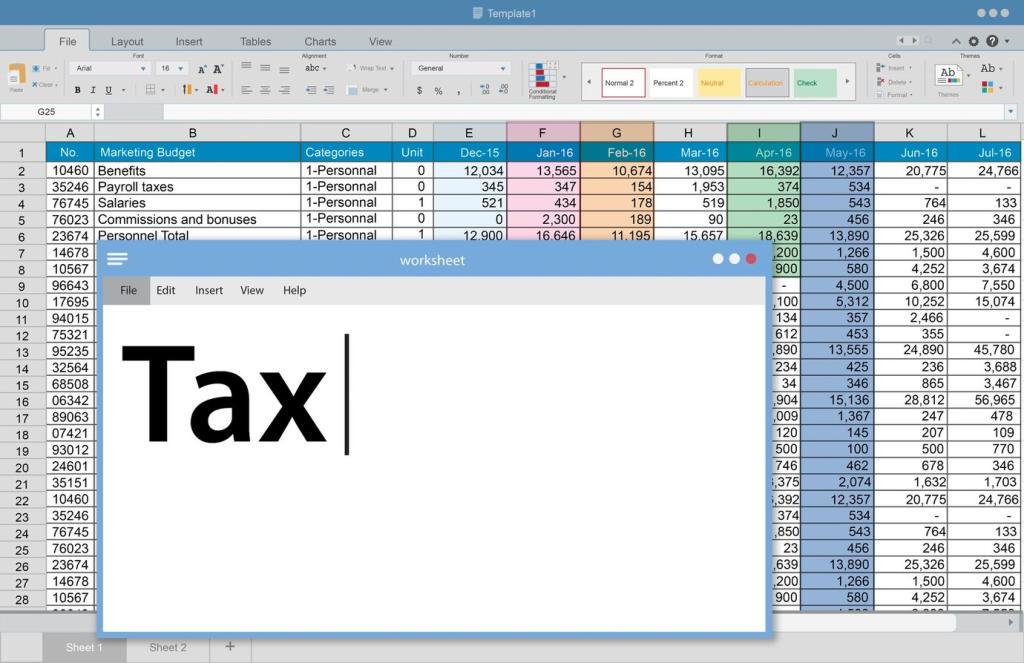

Understanding the Indian Income Tax Landscape

Income tax is money individuals contribute on their earnings so public services run, records stay transparent, and savings choices matter. Knowing the basics helps you avoid penalties and plan smarter each year. What do you find most confusing?

Residential Status and the Scope of Your Income

Resident, Non-Resident, and RNOR in plain words

Day-count tests determine whether you are Resident, Non-Resident, or RNOR. The label changes which global incomes are taxable here. Keep travel dates handy, and double-check them before filing. Ask for our printable checklist in the comments.

Why status shapes what gets taxed

Residents are typically taxed on global income; Non-Residents on Indian-sourced income; RNOR has a middle ground. This single classification can prevent costly double taxation surprises. Tell us a scenario you want explained with examples.

A quick story: Priya’s unexpected resident year

Priya worked abroad but visited India longer than planned, tipping her into Resident status. Her foreign interest needed reporting. A simple basics review saved penalties and stress. Share your travel curveball so others learn from it.

Heads of Income: The Five Buckets You Should Know

01

Salary: payslips, perquisites, and standard deduction

Salary includes basic pay, allowances, bonus, and perquisites. The standard deduction offers a simple reduction for salaried individuals. Check Form 16 details carefully. Drop a comment if you want a beginner’s payslip walkthrough next week.

02

House Property: self-occupied and let-out fundamentals

Interest on home loans, municipal taxes, and standard deduction rules differ for self-occupied versus let-out property. Understanding loss set-off limits avoids confusion. Tell us if you want a starter worksheet for your specific housing situation.

03

Capital Gains and Other Sources: the everyday version

Selling shares, mutual funds, or property can create capital gains; interest and dividends usually sit in Other Sources. Holding periods and TDS matter. Ask for a basics explainer tailored to your most common investments and savings habits.

Deductions and Exemptions: Simple Ways Individuals Save

Investments like EPF, PPF, ELSS, and principal repayment on a home loan can fit under 80C, capped at a defined limit. Beginners should record contributions monthly. Comment “80C” for a starter spreadsheet template you can copy.

Deductions and Exemptions: Simple Ways Individuals Save

Medical insurance premiums under 80D and eligible donations under 80G reduce taxable income when documented properly. Keep receipts organized and names consistent. Want a basics receipt folder checklist? Say “HEALTH” below to receive it.

TDS, Form 16, 26AS, and AIS: Your Evidence Trail

Form 16 summarizes salary, deductions claimed, and TDS deposited. Compare it with payslips to catch errors early. If figures differ, ask HR for a correction. Want a step-by-step basics audit list? Comment “FORM16” to get our template.

TDS, Form 16, 26AS, and AIS: Your Evidence Trail

26AS shows tax credits like TDS and TCS; AIS lists reported incomes and transactions. Compare both with your records to avoid notices. Never ignore small interest entries. Tell us which line confused you most this season.

Filing Your First Return: Step-by-Step Basics

Picking the right ITR form and regime

Salaried individuals often use ITR-1 or ITR-2 depending on income sources; business income uses ITR-3. Choose old or new regime deliberately. Comment your situation, and we will suggest the basics path to explore confidently.

Using the e-filing portal efficiently

Pre-filled data helps, but you must verify every line. Reconcile numbers with 26AS and AIS, add missing interest, and confirm bank accounts for refunds. Subscribe for our basics portal walkthrough with screenshots and quick reminders.

Who must pay advance tax and when

If expected tax liability exceeds the legal threshold, individuals should pay advance tax in scheduled installments. Salaried people with significant other income should review mid-year. Comment “ADVANCE” if you want quarterly reminder emails and tips.

Self-assessment tax and interest basics

Before filing, compute remaining tax after TDS and advance payments, then pay self-assessment tax if required. This helps avoid interest under sections 234A, 234B, and 234C. Share your calculator questions, and we will answer them simply.

Refund timelines and realistic expectations

Refunds arrive faster when details match and e-verification is timely. Keep your bank account pre-validated and watch email alerts. Tell us your refund timeline story to help first-time filers set patient, realistic expectations this year.