Education, donations, and savings interest: 80E, 80G, 80TTA/80TTB

Claim the entire interest paid on approved education loans for higher studies, for up to eight assessment years. There is no monetary cap, but the lender must be a bank or notified financial institution. Keep the sanction letter and annual interest statements. Unsure whether your course or lender qualifies? Ask below, and we’ll point you to the exact rule you need.

Education, donations, and savings interest: 80E, 80G, 80TTA/80TTB

Donations to eligible funds and institutions qualify at different rates, some with ceilings. Pay via traceable modes; large cash donations generally do not qualify. Preserve receipts showing the institution’s PAN and 80G registration details. If you name the fund you supported, we can help you estimate the eligible deduction right in the comments.

Education, donations, and savings interest: 80E, 80G, 80TTA/80TTB

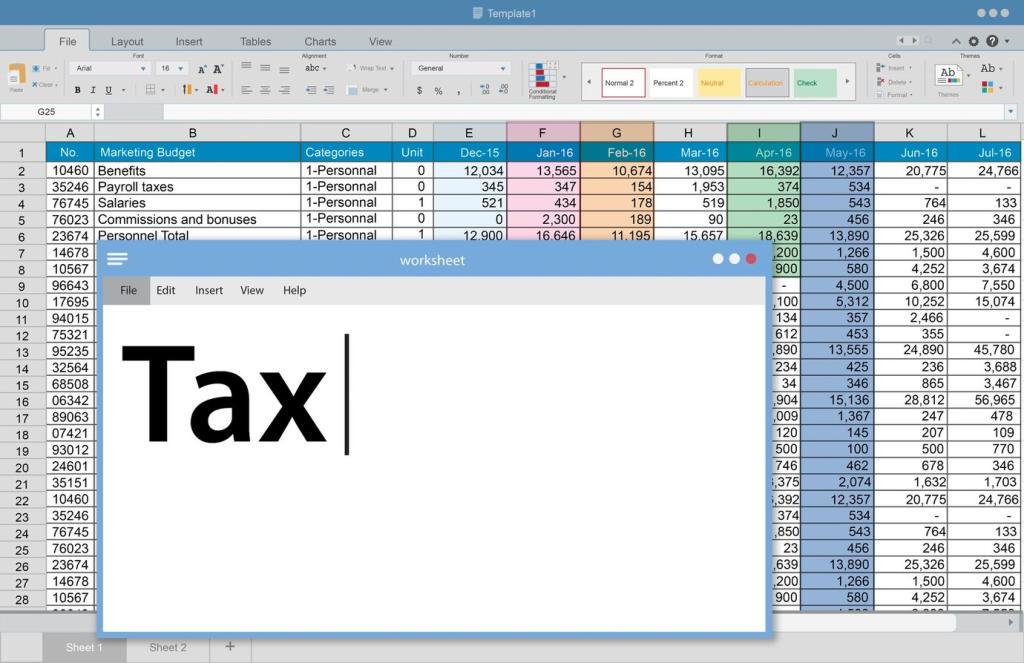

Individuals and HUFs can claim a limited deduction on savings account interest, while senior citizens enjoy a higher limit that also covers bank deposit interest. Track interest through bank statements and reconcile with your tax information statement. Want an easy tracker that auto-updates across accounts? Subscribe and we’ll share our spreadsheet that flags overages automatically.

Education, donations, and savings interest: 80E, 80G, 80TTA/80TTB

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.