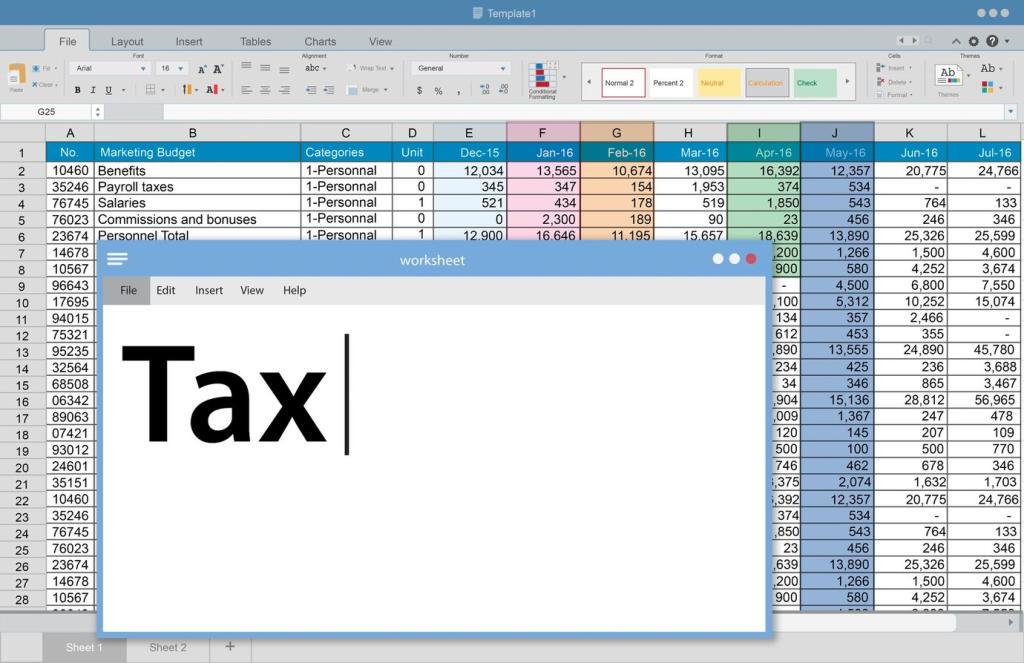

Your Evidence Box: Documents and Data to Gather

Collect Form 16, Form 26AS, AIS/TIS, interest certificates, rent receipts, capital gains statements from brokers, and dividend reports. Prefilled data helps, but confirmations from your employer, banks, and platforms build total confidence.

Your Evidence Box: Documents and Data to Gather

Stack proof for Section 80C investments, 80D health insurance, donations, education loan interest, and home loan interest. Keep HRA rent receipts and landlord PAN where required. Good evidence turns last-minute doubts into quick, decisive clicks.