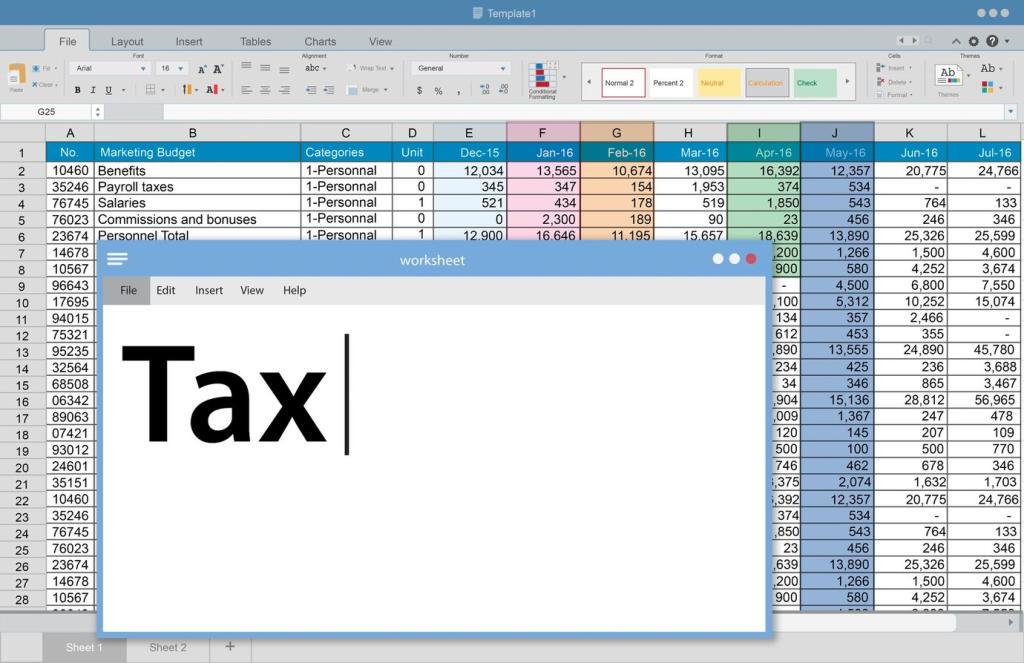

Selecting the Wrong ITR Form

Salaried filers often default to ITR-1, forgetting capital gains from shares or ESOP perquisites push them to ITR-2. Report everything correctly to avoid notices and delays. Ask in comments if your situation feels borderline.

Selecting the Wrong ITR Form

Independent professionals frequently mix up ITR-3 and ITR-4 presumptive options. Turnover, presumptive sections, and expense claims determine the best fit. Unsure which route suits you? Share your revenue pattern, and we’ll break it down together.